What Is A Classroom Economy?

A classroom economy is a classroom behavior management system designed to mimic a real-world economic system. It’s time we invest in our students and bank on good behavior, rather waiting for bad behavior to occur. While economics is considered part of math and social studies curriculum, textbooks and other programs often neglect to incorporate economic instruction.

The classroom economy can fill this void while serving as a fun way for students to act as both consumers and economists in a real world setting. The classroom economy is used as a form of positive behavior management, but it’s real purpose is to help students learn necessary principles of economics throughout the entire school year. Positive behavioral interventions and support (PBIS) is defined as a framework for enhancing the adoption and implementation of a continuum of evidence-based interventions to achieve academically and behaviorally important outcomes for all students (Sugai et al., 2000).

How It Works:

Every month students earn paychecks and bonus money for completing a classroom job and bonus activities such as turning in homework. They also pay fines, electricity bills, and rent for their desks, and they have the opportunity to purchase prizes at auctions (or a school store)—all with classroom economy currency (mock money). They will have the opportunity to save their money and purchase their desks forgoing paying the monthly rent.

Students will be in charge of setting a short and long term goal and keep track of their own finances. They have the option of keeping “classroom cash” or depositing their money into the classroom bank where they will earn a monthly dividend for keeping their money. Much like the “real world”, lost cash is lost cash. Students will not receive more cash to replace their lost cash. They are responsible for keeping their own money in a safe place. Students are also responsible for keeping track of their balance to ensure they have earned enough money by the end of the month to pay their bills.

Standards:

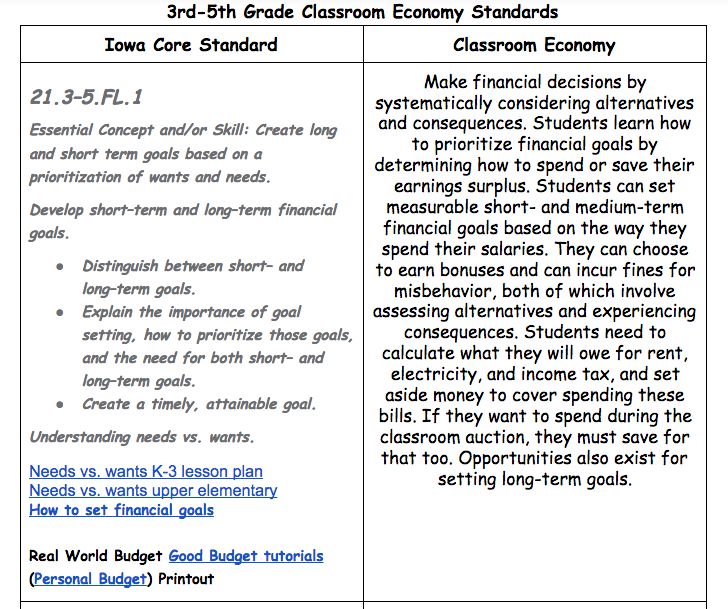

Everything we do in our classrooms should be purposeful. I believe that everything we teach in our classrooms should focus on meeting our state standards. I focus the 21st Century Skills (financial literacy) for my state. Here is an example of the 3rd-5th-grade and 6th-8th-grade financial literacy skills in the state of Iowa (my home state) that connect with the classroom economy. This is on a Google Doc that includes standards for both elementary and middle school. If you would like an editable copy to use to adapt to your needs click on the link below.

Click here for your free editable copy

Click here for your free editable copy

Goals: The students will….

- Understand the value of money as they earn, save and spend money on a consistent basis.

- Learn how our economic system works because they are involved in many roles within a mock economic system within our classroom community.

- Gain a new respect for their parents and people in the workforce as they realize that money doesn’t come easy, rather, it comes from hard work.

- Become prepared to be responsible citizens in our nation’s economic system.

- Understand the monetary value of money and the value of keeping money in the bank.

- Learn how to balance their checking account.

- Understand how to make change and budget their money.

- Become productive members of a simulated workforce.

- Understand and use economic terms such as goods, services, consumer, producer, capital resources, natural resources and human resources.

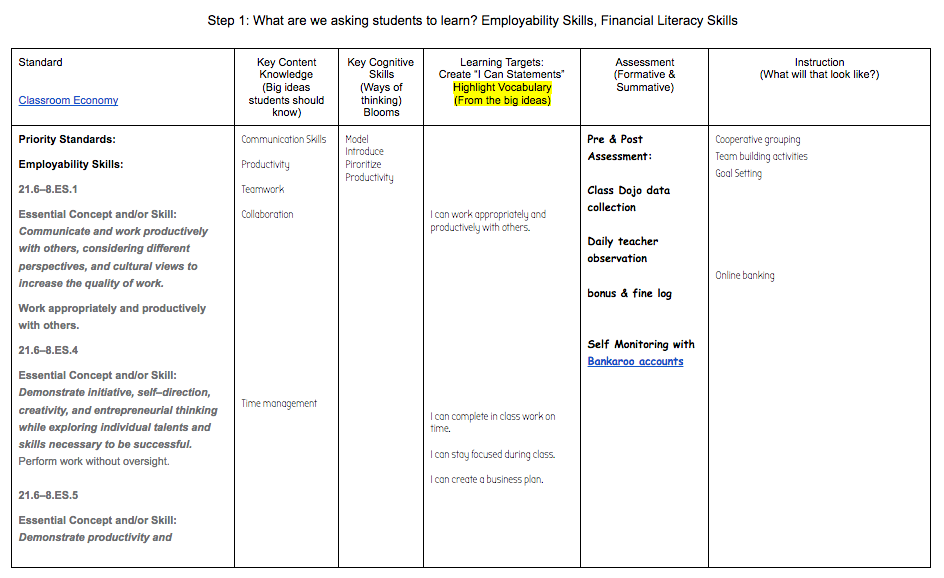

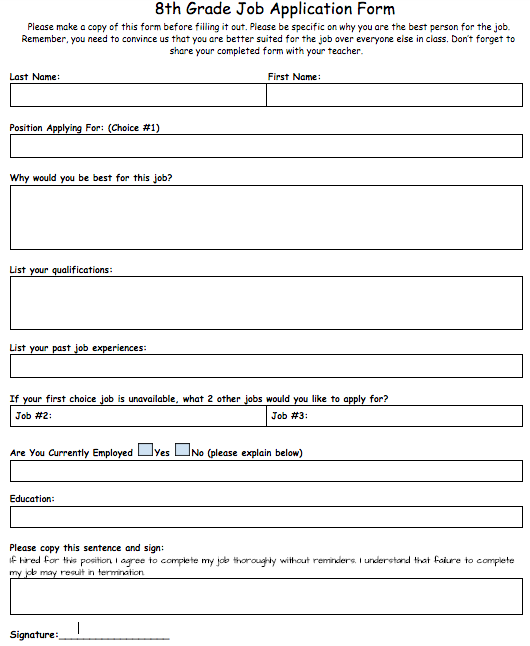

This is an example of how an 8th-grade teacher and I unpacked the Employability Skills/Standards before implementing our classroom economy.

Click here for your free editable copy

How Can I Get Started With A Classroom Economy?

To get started on your classroom economy, check out this video by Thom Gibson, he’s a classroom economy GENIUS!!!!! Check Thom Gibson out here.

The classroom economy program is an effective and enjoyable way to teach your students fundamental financial literacy components without altering your curriculum.

Implementing the program is an easy three-step process:

- Before the school year starts, you spend a few hours gathering materials and planning how to customize the program for your school and your own classroom (or ask your instructional coach for a classroom economy coaching cycle:).

- During the first month of school, you spend some classroom time introducing the program and training the students to complete their tasks (procedures). I like to have my students help come up with the list of bonuses and fines.

- Throughout the year, you monitor the students’ progress and provide support and guidance when necessary.

As they perform their tasks, the students will help you manage the classroom and, in the process, learn valuable skills—such as responsibility, the value of saving, and delayed gratification—that they will carry with them throughout life.

The beauty of the program is that you don’t need to teach too many lessons; rather, your students will experience them and learn for themselves. I have found it beneficial to directly teach a needs vs. wants lesson right before the classroom auction/class store. There’s a thrill in seeing “the light bulb go on” when a student realizes he or she should have saved money for the next month’s rent instead of overpaying for an item at the auction. It’s also amazing to witness the students experience “buyer’s remorse” at the auction.

Classroom Jobs:

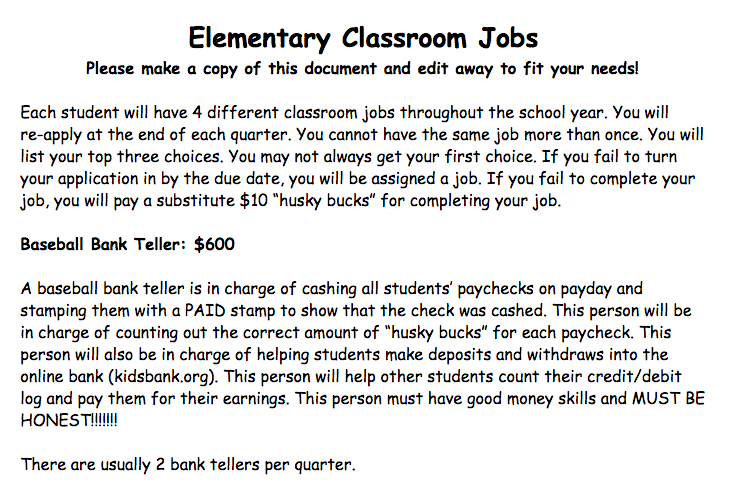

Every student will apply for a classroom job (a different job per quarter). Or, students could keep the same job all year if you choose. Make it your own and set it to what works best for your classroom needs. The students will list their top 3 choices. It is not unusual for many students to want the same job. Your application is your chance to persuade me why you are the best person for the job that you want. If you do not get your first choice job don’t worry, you have a total of 1 more application throughout the school year. If you fail to turn in your job application by the due date, a job will be assigned to you.

Every job is different; therefore, the paycheck prices are also different. Students will be paid (“classroom cash”) at the end of each month for completing their job. Jobs range from $500-$850 per month. You will keep the same job for 9 weeks at a time (each quarter). Students can be fired for not completing their job. If you would like an editable copy of the classroom jobs, click on the link below. This is on a Google Document. You will just need to make a copy of the document to make it your own. This document includes job examples for elementary students (I used with my own 3rd graders) and middle school job examples (I used in an 8th-grade math coaching cycle).

Click here for your free copy of classroom jobs

Bonus $ And Fines:

Bonuses

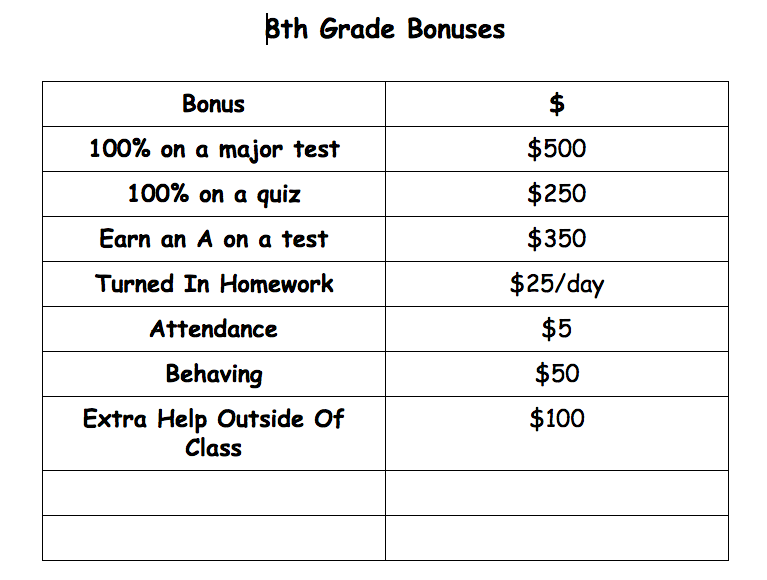

In addition to the salaries that you earn from your jobs, you can earn bonus money by performing well academically and participating in extra activities. You will need to earn bonuses to make rent and save up for the auction as your paychecks are not enough to pay rent. In addition, bonuses can be useful incentives for your own class goals.

Fines

In the classroom economy, the role of fines is to help you understand costs and consequences—it is not to punish you. Click on the link below for your free editable copy of the classroom bonus/fine Google Document. To adapt this to your needs please make a copy of the original document and edit away! I created these with the students, which is very important for student buy-in and ownership.

Click here for your free editable copy

Introducing The Classroom Economy To Your Students:

I print a copy of the student/parent info packet out for each middle school student and share the parent packet at elementary open house. Make sure you start with a broad overview. Don’t share all of the information at once, it could be very overwhelming to students. For younger students, I usually just explain what it is on the first day, then pick one section to go over one day at a time until everything has been communicated.

Older students can usually handle more information at once, so I usually share more with them the first day. I usually don’t explain payday or the auction until right before we do them. There will be TONS of questions and LOADS of excitement. After explaining the system to your students and having them help come up with the bonus/fine list.

Hiring Students For Classroom Jobs:

Use your best judgment. I always start with the jobs that only one student has applied for. It is important to keep track of which jobs each student has applied for so that if they don’t get their first choice, they will have future opportunities to get them (if your students will be changing jobs throughout the year). I use a job application which requires students to list their top 3 choices and requires them to sell themselves on why they are the best student for the job. This is designed to mimic a real-world job application. I also hold interviews if there are multiple students applying for the same job. Use the link below to grab your own editable copy of the job application. Please just make a copy in order to make it your own. I have this on a Google Doc that I share with the older students. I print a copy and have younger students fill out by hand.

Click here for your free copy

Setting Up Your Online Bank:

I have used both Kidsbank and Bankaroo. I prefer Bankaroo because it has an app option where students can access their bank account information using a cell phone or iPad as well as online using a computer. Both options allow teachers to choose one or two students (the bankers) to have full access to add funds, while all other students can just view their funds. There are positives and negatives with both options. Check out this video that explains the positives and negatives from Thom Gibson.

Putting Your Student On A Budget:

I used the envelope budgeting system to put my students on a budget. They were responsible for creating their own goals and creating their own digital envelopes within their Bankaroo accounts. This is another reason why I prefer Bankaroo over Kidsbank. Check out this video on envelope budgeting by Jordan Page from funcheaporfree.com. This girl is seriously entertaining and super informative.

Classroom Auctions:

Classroom auctions are held at the end of each month, after payday has occurred. I have student auctioneers with the older students and I am the auctioneer with younger students. Once all of the students have been paid for their jobs and bonuses and fines and rent have been deducted and money has been budgeted, it’s time for the fun to begin. My students don’t use auction paddles or have numbers, I just have them raise their hands to bid. My student auctioneer runs my auction. This student sets the starting bid for each item. The auctioneer works with the bankers and the secretary during the auction. The secretary keeps track of everything purchased at the auction and the bankers collect the payments.

This is not exactly how my classroom auction goes, but I thought it is a pretty fun example of what it could look like. I think I might try this in my classroom.

I collect items from local businesses such as free 6″ sub coupons from Subway, donated items and have gone on some corporate gas station websites and have been lucky enough to get some gift cards. In addition, I have created teacher freebies that I auction off. You can find a link to my free auction tags below. I also have items that students are interested in. This year I have added squishies, slime, scrunchies, laptop stickers, slap bracelets. All items are pretty cheap on Amazon for a pretty large quantity. Other hot itmes include school spirit items like water bottles, balls, bags, hats and t-shirts with our school logo.

Click here for your free copy

Purchasing Your Desk:

Students learn that if they save their money and purchase their desks, they won’t need to pay rent again and will get to keep most of their paychecks. They will still need to pay the bills (electricity, taxes…), but in the long run, will make better financial decisions and will get to keep most of their hard earned money. I also give my students the opprotunity to save their money and purchase another desk. They then become the landlord and the student’s desk they purchased pays their rent to the new owner. The point of this is to minic the real world as much as possible. Students whose desks have been bought by another student still have the opprotunity to purchase their desk from their new landloard as soon as they are able to. Students earn a certificate when they purchase their desks to show ownership. This is a proud moment for students.

This is a great teaching opprotunity to discuss Monopoly. With my 3rd graders we had a Monopoly board game tournament. I like to use the Ultimate Banking Monopoly.

Wow, this is got it all! 🙂 Glad you were able to use my videos in all of this. I had never heard of Bankeroo but got super excited when I saw it. I’ve wanted a ‘all in one’ banking and budgeting system (and the ‘mykidsbank’ interface does leave something to be desired). Will definitely be trying it out this next year! Thanks for sharing 🙂